Discover Our Approach

Trusted Non-Resident Real Estate Tax Guidance

Our team of certified cross-border tax specialists brings decades of experience helping first-time filers across Canada understand and manage their US-Canada tax obligations.

We deliver personalized tax education, step-by-step filing guidance, and compliance solutions built around your unique cross-border situation and tax residency status.

We believe guiding new cross-border filers is more than completing forms. It is about educating you on your obligations, establishing strong compliance foundations, and building confidence in managing ongoing US-Canada tax requirements. Our commitment to transparency and client-focused education sets us apart in the Canada cross border tax community.

First Time Filers Guided

Client Understanding Rate

Tax Education Sessions

Ongoing Compliance

Your Cross-Border Tax Future

New to Cross-Border Filing Services

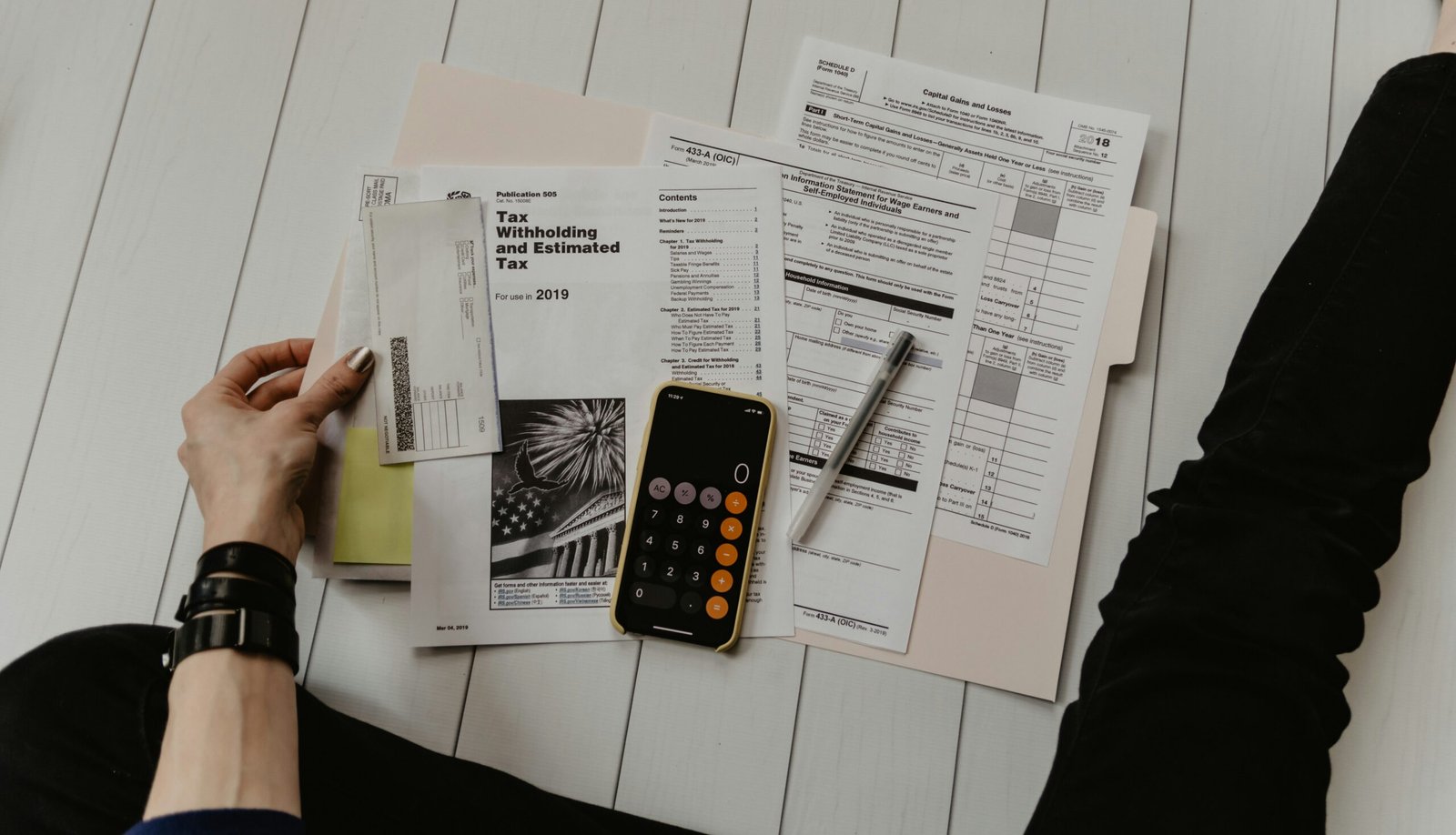

Our Canada based cross border tax team delivers expert guidance for clients navigating their first US-Canada tax filing experience. We serve new dual citizens, first-time cross-border workers, and recent expatriates with educational tax support and compliant filing solutions for both CRA and IRS.

From understanding basic obligations to completing your first returns, our certified tax specialists provide clear explanations and patient service. Every filing experience we create reflects your unique learning needs and establishes solid foundations for future cross-border tax compliance.

First Time Filing Assessment

Comprehensive review of your cross-border situation to identify all US-Canada tax obligations and filing requirements.

Tax Obligation Education

Clear explanations of CRA and IRS requirements, including deadlines, forms,s and ongoing compliance responsibilities.

Guided Return Preparation

Step-by-step support through your first cross-border tax return preparation and filing process.

Why Choose Us

Trusted Experts for New Cross Border Filers

We simplify the complexities of first time cross border filing and dual country tax requirements. Our dedicated team across Canada delivers patient, educational guidance that builds your understanding and ensures full compliance with CRA and IRS from day one.

Our Canada based team specializes in supporting new cross-border filers and first-time dual country tax situations. We serve first-time dual citizens, new cross-border workers, and recent expatriates with clear education, precise preparation, and ongoing compliance support.

From basic obligation explanations to complex residency determinations, we handle every detail with patience and clarity. Our tax specialists provide personalized attention to help you understand tax treaties, filing requirements, and CRA IRS regulations that protect your interests as a new cross-border filer.

Our Values

A Firm Built on Trust and Educational Excellence

Our Canada-based cross-border tax team combines deep bilateral tax knowledge with a genuine commitment to first-time filer education. We deliver reliable solutions and patient guidance for new dual citizens, first-time cross-border workers, and recent expatriates.

Email Us

support@crossborder-taxes.ca

Address

Toronto, Ontario M5H 2N2, Canada

Call Us

+1 (587) 885-4212